Using Odoo simplifies the management of your company by streamlining accounting processes, reducing the time required for your accountant to perform monthly, quarterly, or annual closings. With the integration of the QR-Code, Odoo is now fully compatible with Swiss accounting standards.

Our clients manage three main transaction flows, and we take care of the rest:

- entering supplier invoices

- issuing customer invoices

- assigning bank movements to open invoices.

Proper management of these processes ensures that the accounting is always up-to-date.

Supplier Invoices

To process supplier invoices, Odoo offers two options: manual or automated accounting through a paid scanning service. Odoo’s artificial intelligence scans imported invoices and automatically extracts essential data, such as the supplier, reference, amounts and expense accounts, so that you only have to validate the invoice.

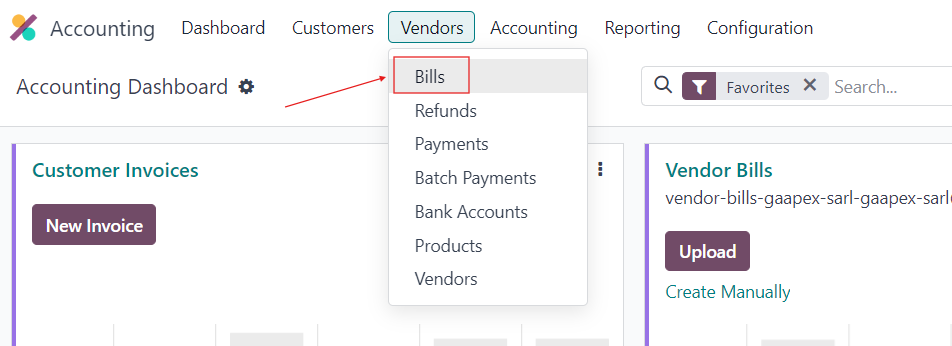

To manually enter an invoice, first create the supplier in Odoo if it doesn’t already exist, then go to the Accounting application, Vendors menu and select Bills.

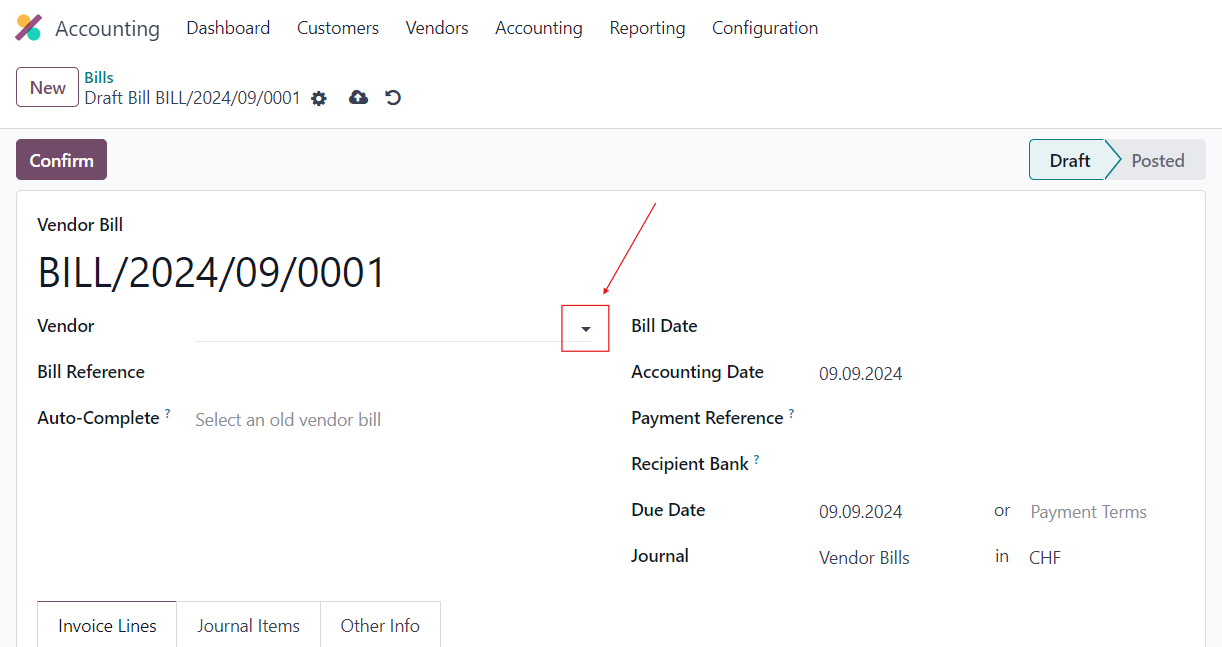

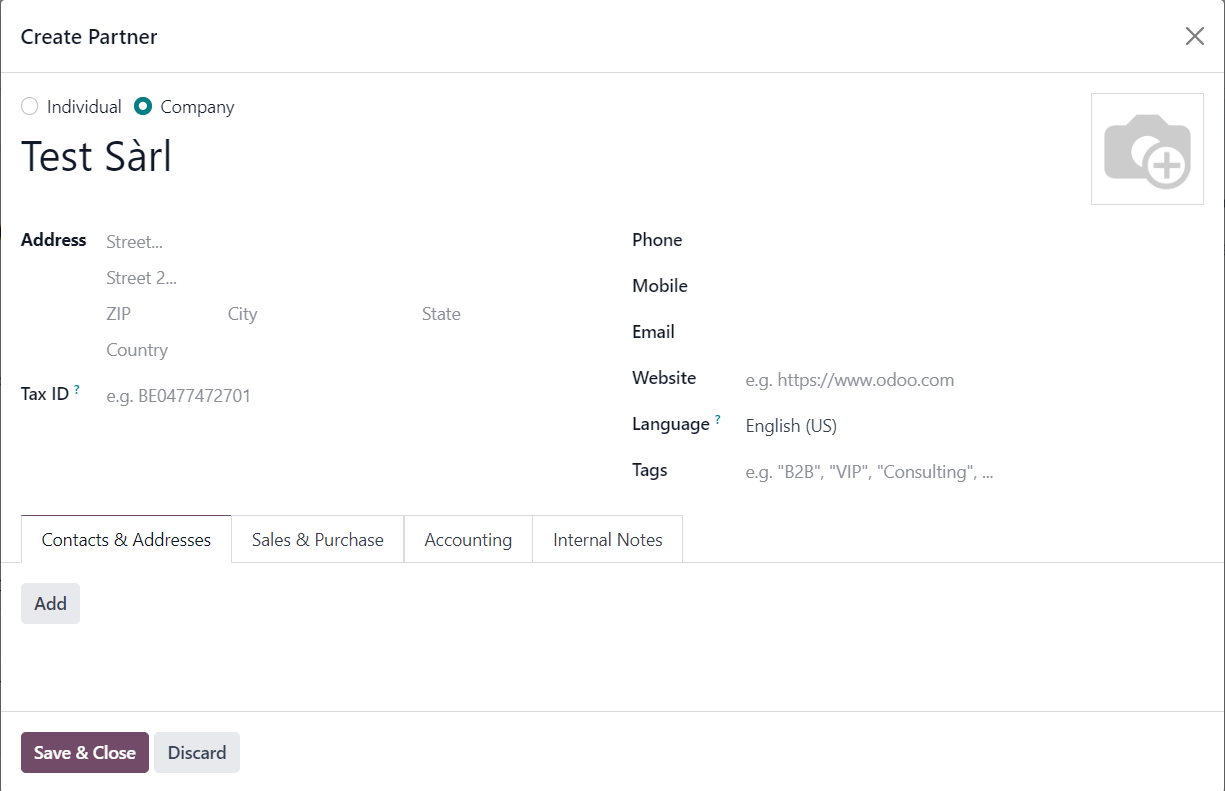

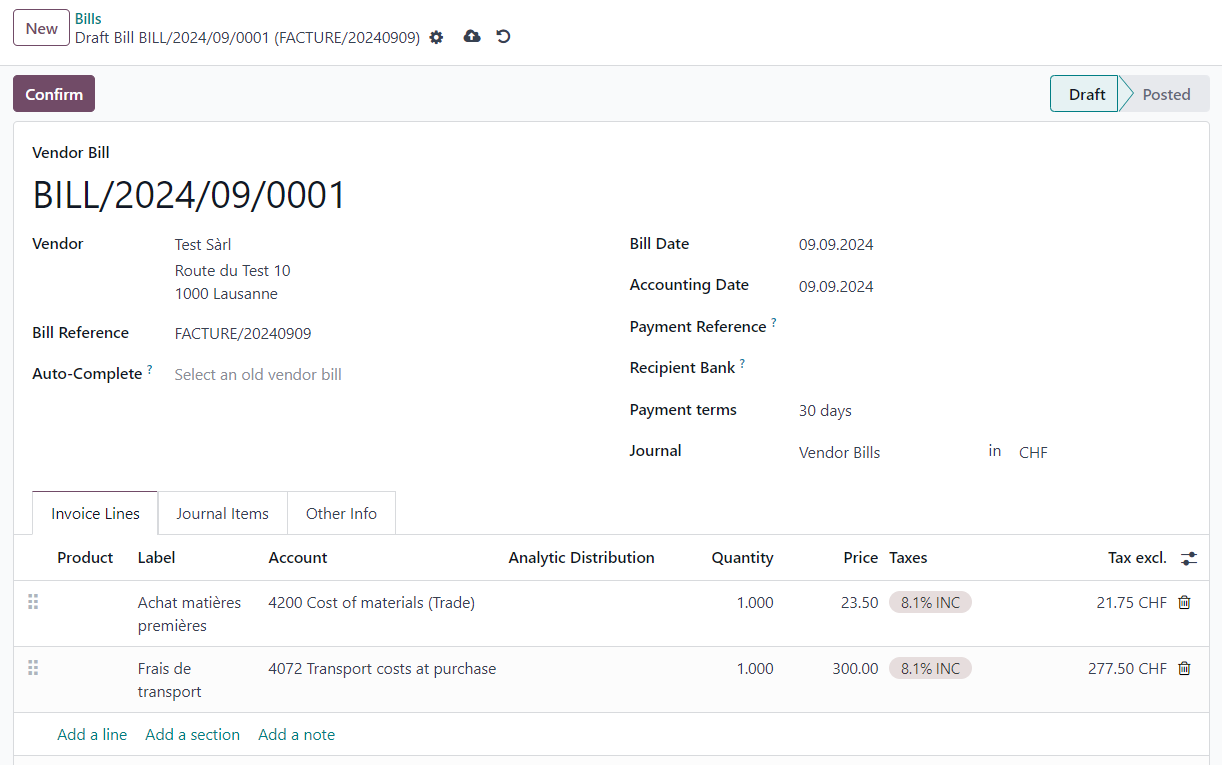

You then have to create a new bill and select the corresponding vendor or create one if it doesn’t exist yet. Filling in the vendor’s information, such as their address and bank details, is recommended to simplify future payment management.

Once the supplier is added, fill in the other necessary fields on the invoice: indicate the date, invoice number and payment reference (such as the BVR number or another code). Describe the services provided by the supplier, select the appropriate accounting account and choose the applicable VAT. These steps ensure that the invoice is correctly accounted for and ready for further processing.

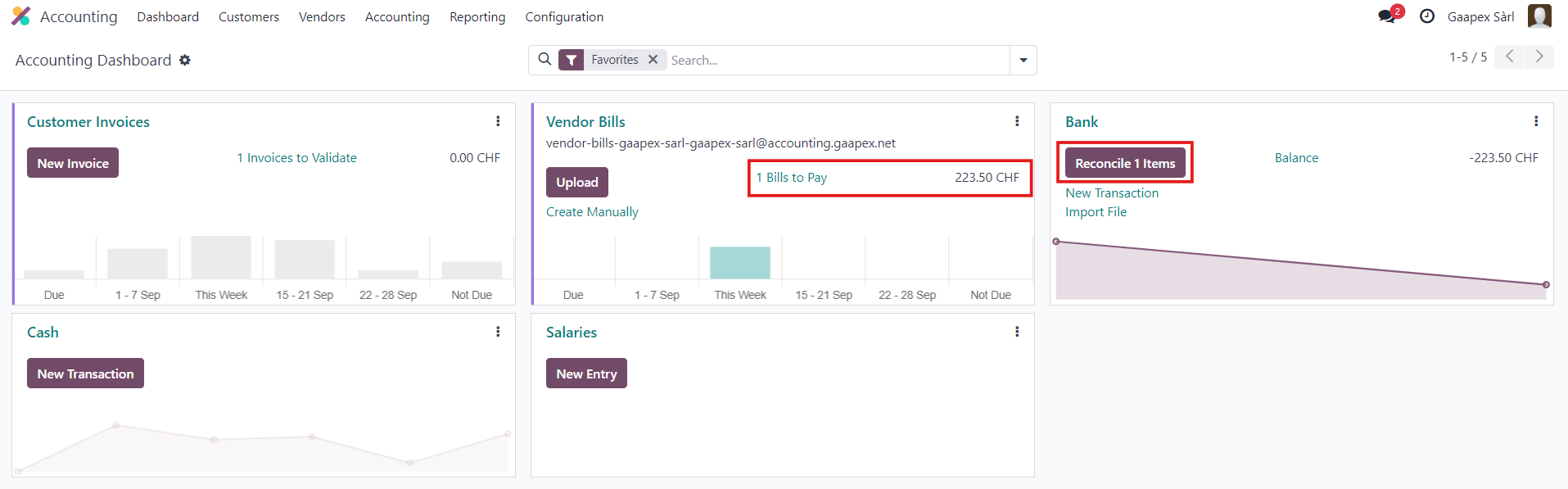

After entering all the information, save and book the invoice. It will then appear in the supplier debt account until it is paid. In Odoo, the invoice will be visible on the dashboard under “bills to pay”.

When bank statements are imported, it will be possible to reconcile the invoice with the corresponding payment. This process guarantees that transactions are correctly tracked and accounted for in the system for an effective financial management.

Customer Invoices

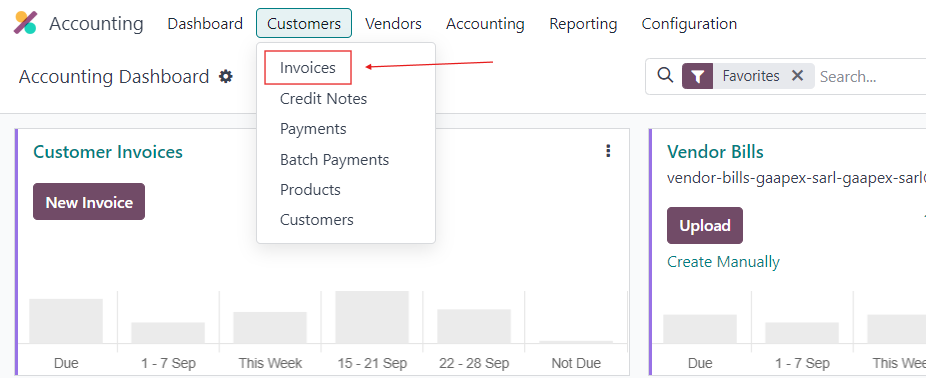

Creating customer invoices and reconciling them with bank transactions follows a similar procedure to that of supplier invoices. The main difference lies in the tab to be selected: for customer invoices, go to Customers – Invoices. The rest of the process, including entering information and reconciling with payments, follows the same steps, ensuring accurate and up-to-date accounting in Odoo.

Odoo allows you to send customer invoices directly by email and automate late payment tracking with automatic reminders based on specific conditions. This feature simplifies customer invoice management and follow-up. Additionally, Odoo offers various analysis tools to track customer and supplier invoices, providing a clear overview of your accounting. These tools enable you to maintain organized accounting and reduce the time spent on manual payment tracking.

Bank Statement Import and Reconciliation

Odoo allows the import of bank statements in several formats:

- CSV

- OFX

- CAMT.053 (recommended)

It is also possible to connect your bank accounts directly to Odoo for an automatic import of daily transactions.

After the import of the statement, transaction reconciliation is done by clicking on “Reconcile X items”. This feature facilitates bank reconciliation and ensures up-to-date accounting without additional manual effort.

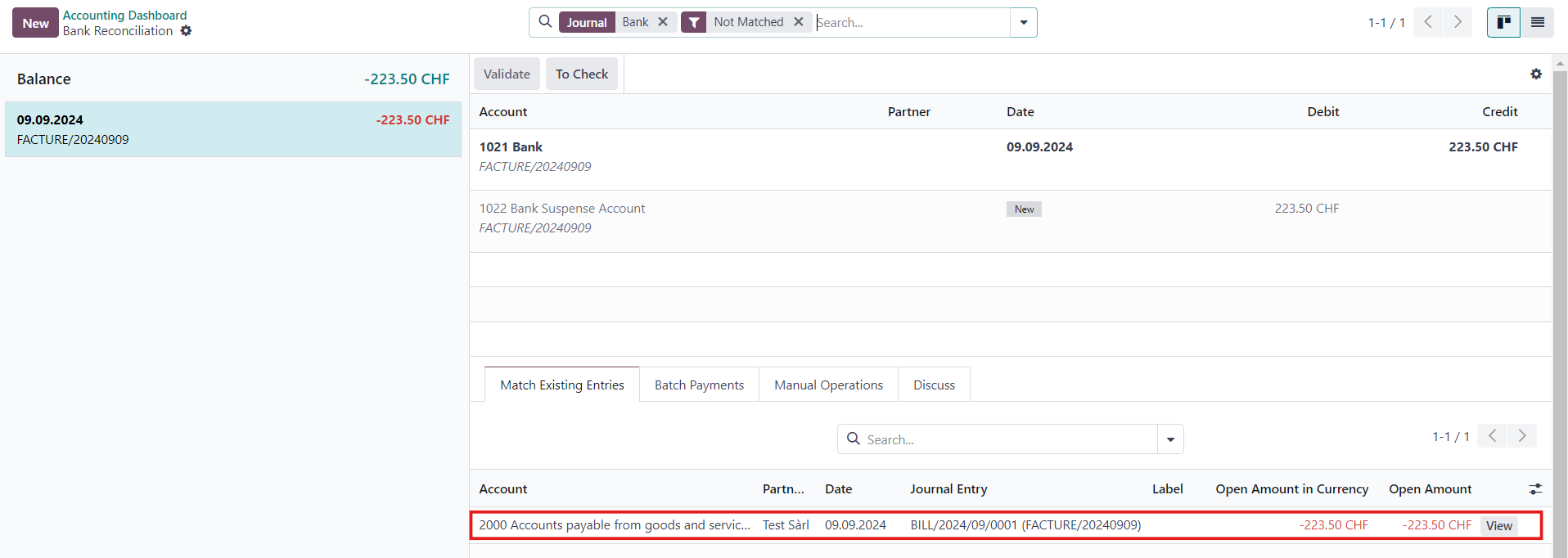

During the reconciliation of the transactions, all bank operations will appear in your window, ready to be reconciled with supplier invoices, customer invoices, etc.

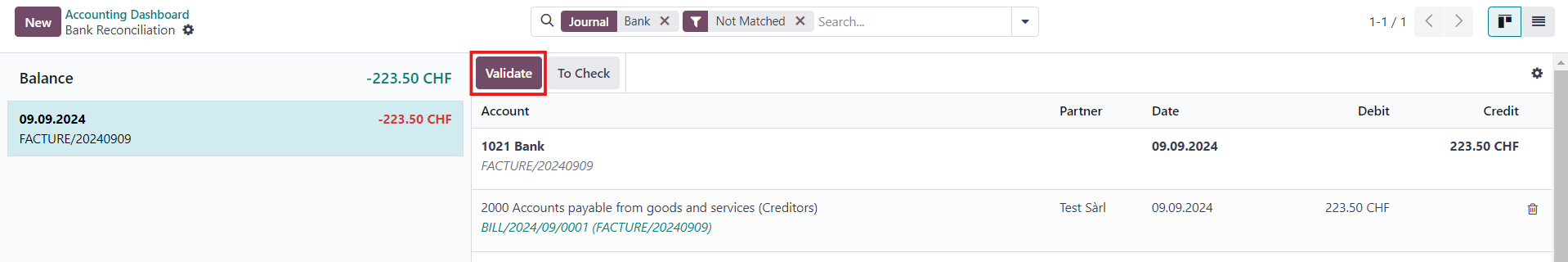

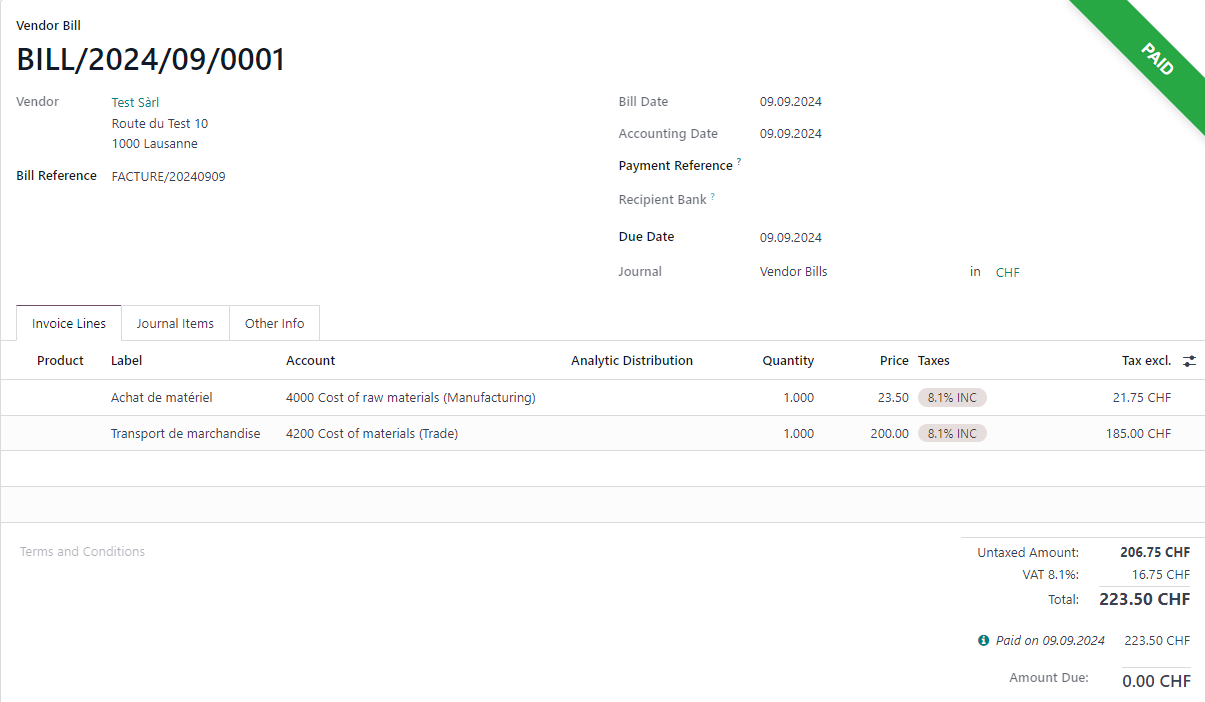

For example, if a payment of CHF 223.50 was made to Test Sàrl on September 9, 2024 for an invoice that was created previously, Odoo uses the information already recorded to try to automatically link the payment to the invoice.

You will then only need to select the corresponding invoice and validate the transaction, thus simplifying bank reconciliation.

When you reconcile a payment with an invoice in Odoo, the invoice status is automatically updated to “paid” or “partially paid” if the payment is made in multiple stages. This allows a precise tracking of the payment status of your supplier invoices, offering optimal accounting management and clear visibility of ongoing and completed transactions.

Conclusion

Odoo facilitates the semi-automation of accounting tasks, offering significant time savings thanks to its intuitive interface. Beyond basic functions, Odoo can be configured to meet the specific needs of your business, such as automatic import of bank transactions, generation of PAIN payment files and integration of modules for inventory management, employee management and payroll. Analytical accounting is also available to optimize business management without frequent manual entries.

Additional Information :

We are at your disposal for any additional information. If you are looking for an accounting firm to support you in integrating a management software, preparing financial statements, providing accounting and financial advice, or for any other request, do not hesitate to contact us and we will analyze your situation together. Contact us: https://www.gaapex.ch/contact/

Recent Comments